QuickLinks-- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant /X/

Filed by a Party other than the Registrant / /

Check the appropriate box:

/ / Preliminary Proxy Statement

/ / Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

/X/ Definitive Proxy Statement

/ / Definitive Additional Materials

/ / Soliciting Material Pursuant to Section240.14a-11(c) or

Section240.14a-12

LOUISVILLE GAS AND ELECTRIC COMPANY

- --------------------------------------------------------------------------------

(Name of Registrant as Specified In Its Charter)

- --------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

/X/ No fee required.

/ / Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11.

(1) Title of each class of securities to which transaction applies:

-----------------------------------------------------------------------

(2) Aggregate number of securities to which transaction applies:

-----------------------------------------------------------------------

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

-----------------------------------------------------------------------

(4) Proposed maximum aggregate value of transaction:

-----------------------------------------------------------------------

(5) Total fee paid:

-----------------------------------------------------------------------

/ / Fee paid previously with preliminary materials.

/ / Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

-----------------------------------------------------------------------

(2) Form, Schedule or Registration Statement No.:

-----------------------------------------------------------------------

(3) Filing Party:

-----------------------------------------------------------------------

(4) Date Filed:

-----------------------------------------------------------------------

[LOGO]

March 26, 1999

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: | ||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 | |

Louisville Gas and Electric Company | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

December 5, 2001

Dear Louisville Gas and Electric Company shareholder:Shareholder:

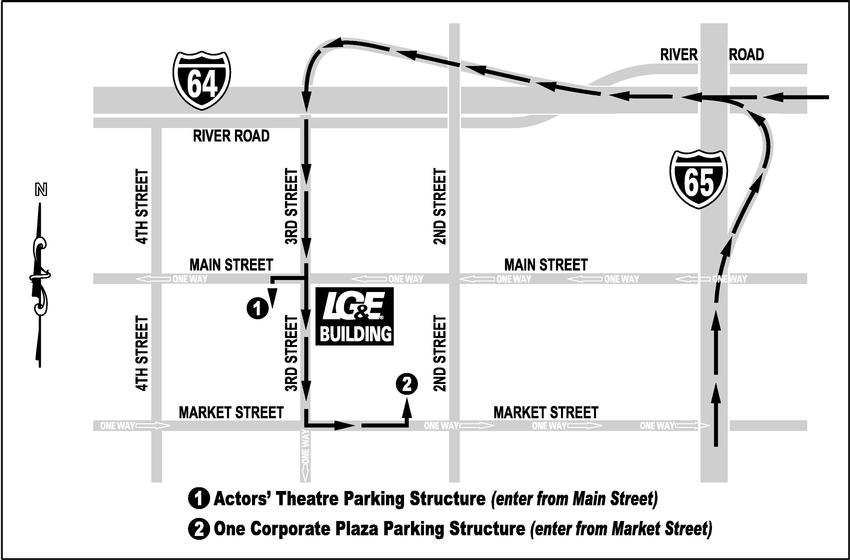

You are cordially invited to attend the Annual Meeting of Shareholders of Louisville Gas and Electric Company to be held on Wednesday, April 21, 1999,December 19, 2001 at 10:2:00 a.m.p.m., E.D.T.local time at the Kentucky Center forThird Floor Assembly Room at the Arts, 501 WestLG&E Building, Third and Main Street,Streets, Louisville, Kentucky.

Business items to be acted upon at the Annual Meeting are the election of nineseven directors, the approval of Arthur AndersenPricewaterhouseCoopers LLP as independent auditors of the Company for 19992001 and the transaction of any other business properly brought before the meeting. Additionally, we will report on the progress of LG&E and shareholders will have the opportunity to present questions of general interest.

We encourage you to read the proxy statement carefully and complete, sign and return your proxy in the envelope provided, even if you plan to attend the meeting. Returning your proxy to us will not prevent you from voting in person at the meeting, or from revoking your proxy and changing your vote at the meeting, if you are present and choose to do so.

If you plan to attend the Annual Meeting, please check the box on the proxy card indicating that you plan to attend the meeting. Please bring the Admission Ticket, which forms the top portion of the form of proxy, to the meeting with you. If you wish to attend the meeting but do not have an Admission Ticket, you will be admitted to the meeting after presenting personal identification and evidence of ownership.

The directors and officers of LG&E appreciate your continuing interest in the business of LG&E. We hope you can join us at the meeting.

Sincerely,

[SIGNATURE]

Roger W. Hale

CHAIRMAN OF THE BOARD AND

CHIEF EXECUTIVE OFFICER

[LOGO]

Victor A. Staffieri

Chairman of the Board, President and

Chief Executive Officer

![]()

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders of Louisville Gas and Electric Company ("LG&E"), a Kentucky corporation, will be held at the Kentucky Center forThird Floor Assembly Room in the Arts, 501 WestLG&E Building, Third and Main Street,Streets, Louisville, Kentucky, on Wednesday April 21, 1999,December 19, 2001 at 10:2:00 a.m.p.m., E.D.T.local time. At the Annual Meeting, shareholders will be asked to consider and vote upon the following matters, which are more fully described in the accompanying proxy statement:

- 1.

- A proposal to elect

ninethree directorsfiveforthree-yearterms expiring in 2002, two directors fortwo-yearterms expiring in20012003 and two directors forone-yearterms expiring in2000;2004; - 2.

- A proposal to approve and ratify the appointment of

Arthur AndersenPricewaterhouseCoopers LLP as independent auditors of LG&E for1999;2001; and - 3.

- Such other business as may properly come before the meeting.

The close of business on February 16, 1999November 21, 2001 has been fixed by the Board of Directors as the record date for determination of shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

You are cordially invited to attend the annual meeting.WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND RETURN YOUR PROXY IN THE REPLY ENVELOPE AS SOON AS POSSIBLE. Your cooperation in signing and promptly returning your proxy is greatly appreciated.

By Order of the Board of Directors,

John R. McCall, Secretary

Louisville Gas and Electric Company

Company.

220 West Main Street

Louisville, Kentucky 40202

March 26, 1999

December 5, 2001

PROXY STATEMENT

--------------------

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD APRIL 21, 1999

----------------------DECEMBER 19, 2001

The Board of Directors of Louisville Gas and Electric Company ("LG&E" or the "Company") hereby solicits your proxy, and asks that you vote, sign, date and promptly mail the enclosed proxy card for use at the Annual Meeting of Shareholders to be held April 21, 1999,December 19, 2001, and at any adjournment of such meeting. The meeting will be held at the Kentucky Center forThird Floor Assembly Room of the Arts, 501 WestLG&E Building, Third and Main Street,Streets, Louisville, Kentucky. This proxy statement and the accompanying proxy were first mailed to shareholders on or about March 26, 1999.December 5, 2001.

If you plan to attend the meeting, please check the box on the proxy card indicating that you plan to attend the meeting. Also, please bring the Admission Ticket, which forms the top portion of the form of proxy, to the meeting with you. Shareholders who do not have an Admission Ticket, including beneficial owners whose accounts are held by brokers or other institutions, will be admitted to the meeting upon presentation of personal identification and, in the case of beneficial owners, proof of ownership.

The outstanding stock of LG&E is divided into three classes: Common Stock, Preferred Stock (without par value), and Preferred Stock, par value $25 per share. At the close of business on February 16, 1999,November 21, 2001, the record date for the Annual Meeting, the following shares of each were outstanding:

| Common Stock, without par | 21,294,223 shares | |

| Preferred Stock, par value $25 per share, 5% | 860,287 shares | |

| Preferred Stock, without par value, $5.875 | 250,000 shares | |

| Auction Series A (stated value $100 per share) | 500,000 shares |

All of the outstanding LG&E Common Stock is owned by LG&E Energy Corp. ("LG&E Energy"). Based on information contained in a Schedule 13G originally filed with the Securities and Exchange Commission in October 1998, AMVESCAP PLC, a parent holding company, reported certain holdings in excess of five percent of LG&E's Preferred Stock. AMVESCAP PLC, with offices at 1315 Peachtree Street, N.W., Atlanta, Georgia 30309, and certain of its subsidiaries reported sole voting and dispositive power as to no shares and shared voting and dispositive power as to 43,000 shares of LG&E Preferred Stock, without par value, $5.875 Series, representing 17.2% of that class of Preferred Stock. The reporting companies indicated that they hold the shares on behalf of other persons who have the right to receive or the power to direct the receipt of dividends or the proceeds of sales of the shares. No other persons or groups are known by management to be beneficial owners of more than five percent of LG&E's Preferred Stock. As of February 16, 1999, allNovember 21, 2001, no directors, nominees for director andor executive officers of LG&E as a group beneficially owned noany shares of LG&E Preferred Stock.

Owners of record of LG&E Energy Common Stock at the close of business on February 16, 1999,November 21, 2001 of theLG&E Common Stock and the 5% Cumulative Preferred Stock, par value $25 per share (the "5% Preferred Stock") are entitled to one vote per share for each matter presented at the Annual Meeting or any adjournment thereof. In addition, each shareholder has cumulative voting rights with respect to the election of directors. Accordingly, in electing directors, each shareholder is entitled to as many votes as the number of shares of stock owned multiplied by the number of directors to be elected. All such votes may be cast for a single nominee or may be distributed among two or more nominees. The persons named as proxies reserve the right to cumulate votes represented by proxies that they receive and to distribute such votes among one or more of the nominees at their discretion.

1

You may revoke your proxy at any time before it is voted by giving written notice of its revocation to the Secretary of LG&E, by delivery of a later dated proxy, or by attending the Annual Meeting and voting in person. Signing a proxy does not preclude you from attending the meeting in person.

1

Directors are elected by a plurality of the votes cast by the holders of LG&E's Common Stock and 5% Preferred Stock at a meeting at which a quorum is present. "Plurality" means that the individuals who receive the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting. Consequently, any shares not voted (whether by withholding authority, broker non-vote or otherwise) have no impact on the election of directors except to the extent the failure to vote for an individual results in another individual receiving a larger percentage of votes.

The affirmative vote of a majority of the shares of LG&E Common Stock and 5% Preferred Stock represented at the Annual Meeting is required for the approval of the independent auditors and any other matters that may properly come before the meeting. Abstentions from voting on any such matter are treated as votes against, while broker non-votes are treated as shares not voted.

LG&E Energy owns all of the outstanding LG&E Common Stock, and intends to vote this stock in favor of the nominees for directors as set forth below, thereby ensuring their election to the Board. LG&E Energy also intends to vote all of the outstanding LG&E Common Stock in favor of the appointment of Arthur

AndersenPricewaterhouseCoopers LLP as the independent auditors for LG&E as set forth in Proposal No. 2. Nonetheless, the Board encourages you to vote on each of these matters, and appreciates your interest.

The AnnualLouisville Gas and Electric Company 2000 Financial Report, to Shareholders of LG&E Energy (the "Annual Report"),

including its consolidated financial statements and information regarding LG&E,

is enclosed with this proxy statement. The Annual Report is supplemented bycontaining audited financial statements of LG&E and management's discussion of such financial statements, which are included as an appendix to this proxy statement (the "Appendix""Financial Report"), and are incorporated by reference herein. All shareholders are urged to read the accompanying Annual ReportFinancial Report.

On December 11, 2000, Powergen plc, a public limited company with registered offices in England and Appendix.

Wales ("Powergen") completed its acquisition of LG&E Energy, the parent corporation of LG&E, for cash of approximately $3.2 billion, or $24.85 per share of LG&E Energy common stock. In connection with such transaction, certain officers and directors of Powergen were appointed to fill vacancies in the Board of Directors of LG&E occurring by resignation of prior directors.

On April 9, 2001, E.ON AG ("E.ON") announced a conditional offer to purchase all the common shares of Powergen, the indirect corporate parent of LG&E and KU. The transaction is subject to a number of conditions precedent, including the receipt of regulatory approvals from European and United States governmental bodies, in form satisfactory to the parties. Among the primary United States regulatory approvals are: the Kentucky Public Service Commission ("KPSC"), the Virginia State Corporation Commission ("VSCC"), the Securities and Exchange Commission, and the Federal Energy Regulatory Commission ("FERC"). Regulatory orders approving the E.ON transaction have been received from the KPSC, VSCC and FERC. The parties anticipate that the remaining approvals may be received by early 2002 to permit completion of the transaction in spring 2002. However, there can be no assurance that such approvals will be obtained in form or timing sufficient for such dates.

In October 2001, the Board of Directors of LG&E authorized the delisting of the 5% Preferred Stock from the NASDAQ Small Capitalization Market. Delisting could occur following applications to the relevant exchanges and applicable regulatory agencies. Delisting does not constitute a change in the terms and conditions of the 5% Preferred Stock nor the rights and privileges of its shareholders. Delisting is proposed in order to enable the Company to realize certain administrative and corporate governance efficiencies following the LG&E Energy-Powergen merger.

2

PROPOSAL NO. 1

The number of members of the Boardboard of Directorsdirectors of LG&E is currently fixed at eighteennine, pursuant to the Company's bylaws and resolutions adopted by the Board of Directors. The directors are classified into three classes, as nearly equal in number as possible, with respect to the time for which they are to hold office. Generally, one class of directors is elected at each year's Annual Meeting to serve for three-year terms and to continue in office until their successors are elected and qualified. However, under Kentucky law, directors appointed to fill vacancies serve terms which expire at the next meeting of shareholders at which directors are elected. These additional required elections are also discussed below.

In May 1998,

On December 11, 2000, upon the closing of the merger (the "Merger") of KU Energy

Corporation ("KU Energy") intotransaction involving Powergen and LG&E Energy, all members of the LG&E Board of Directors, with the exception of Roger W. Hale, resigned, and the size of the Board of Directors was establishedfixed at eighteen. Seven former KU Energynine. Six Powergen directors, Mira S. Ball,

Carol M. Gatton, Frank V. Ramsey, Jr., William L. Rouse, Jr., Charles L.

Shearer, Ph.D., Lee T. Todd, Jr., Ph.D.Paul Myners, Sir Frederick Crawford, Sydney Gillibrand, Edmund Wallis, Dr. David K-P Li, and Michael R. WhitleyRoberto Quarta, and one Powergen officer, David Jackson, were appointed to fill all but one of the vacancies created by the above resignations.

In January 2001, Roger W. Hale announced his resignation as an officer and member of the LG&E Board of Directors, effective April 30, 2001. Victor A. Staffieri and Peter Hickson were appointed to fill the vacancies created by the increase in sizeresignation of Roger W. Hale and the Board.previously-existing vacancy. In December

1998,August 2001, Paul Myners and Roberto Quarta announced their resignations from the Boards of Directors of Powergen and LG&E and Peter Hickson resigned from the Board of Directors of LG&E. Nicholas Baldwin, the Chief Executive Officer of Powergen, was then appointed to fill the vacancy of Mr. Whitley and S. Gordon Dabney retired as directors. Donald C. Swain,

Ph.D., who currently serves with the class of directors whose terms expire atHickson.

At this Annual Meeting, has indicated his present intentionthe following seven persons are proposed for election to retire concurrent

with the Board of Directors, pursuant to Kentucky law requiring that directors appointed to fill vacancies stand for election for the remainder of their unfulfilled terms at the next meeting of shareholders at which directors are elected:

For one-year terms expiring at the 2002 Annual Meeting: Sydney Gillibrand, Victor A. Staffieri and is not standing for re-election as a director.Nicholas P. Baldwin.

For two-year terms expiring at the 2003 Annual Meeting: Edmund A. Wallis and Dr. Swain has served as a director of LG&E since 1985David K-P Li

For three-year terms expiring at the 2004 Annual Meeting: Sir Frederick Crawford and of LG&E Energy since 1990.David J. Jackson.

Despite the remaining vacancies on the Board of Directors, shareholders may not vote for a number of directors greater than the number of nominees named in this proxy statement. Procedures for reviewing

Messrs. Baldwin, Staffieri, Crawford, Gillibrand, Wallis and nominating candidates to theDr. Li are presently directors of Powergen. Messrs. Baldwin, Staffieri and Jackson are presently directors of LG&E Board of Directors are discussed in more detail in "Information Concerning

the Board of Directors--Nominating and Governance Committee."

At this Annual Meeting, the following nine persons are proposed for election

to the Board of Directors:

For three-year terms expiring at the 2002 Annual Meeting: Mira S. Ball,

Roger W. Hale, David B. Lewis, Anne H. McNamara and Frank V. Ramsey, Jr.

For two-year terms expiring at the 2001 Annual Meeting: Carol M. Gatton

and Lee T. Todd, Jr.

For one-year terms expiring at the 2000 Annual Meeting: William L. Rouse,

Jr. and Charles L. Shearer.Energy. All of the nominees are presently directors of LG&E Energy, LG&E and of Kentucky Utilities Company ("KU").

The Board of Directors does not know of any nominee who will be unable to stand for election or otherwise serve as a director. If for any reason any nominee becomes unavailable for election, the Board of Directors may designate a substitute nominee, in which event the shares represented on the proxy cards returned to LG&E will be voted for such substitute nominee, unless an instruction to the contrary is indicated on the proxy card.

The composition of the Board of Directors of LG&E following the completion of E.ON's acquisition of Powergen is not known, but such Board is likely to contain at least one current director or officer of LG&E Energy. Accordingly, certain of the directors of LG&E Energy or LG&E may cease to serve as directors of LG&E in the event the E.ON-Powergen transaction is completed.

3

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF THE NINESEVEN NOMINEES FOR DIRECTOR.

3

INFORMATION ABOUT DIRECTORS AND NOMINEES

The following contains certain information as of February 16, 1999,November 30, 2001 concerning the nominees for director:

Nominees for Directors with Terms Expiring at the 2002 Annual Meeting of Shareholders

Sydney Gillibrand CBE (Age 67). Mr. Gillibrand was appointed a director of Powergen plc on May 31, 1999. He is chairman of AMEC plc and TAG Aviation (UK) and a non-executive director of ICL, and Messier-Dowty. He was previously vice-chairman of British Aerospace plc. Mr. Gillibrand has been a director of LG&E and KU since December 2000.

Nicholas P. Baldwin (Age 48). Chief Executive of Powergen since February 21, 2001. Mr. Baldwin was appointed a director of Powergen plc on October 22, 1998, having been a director of Powergen UK plc since February 1998. Until his appointment as wellChief Executive in February 2001, he was previously Executive Director, UK Operations of Powergen. He joined the CEGB, the predecessor of Powergen in 1980. In the United Kingdom, he is also a director of the Electricity Association and a Director and Trustee of Midlands Excellence and is a representative on the IEA's Coal Industry Advisory Board. Mr. Baldwin has been a director of LG&E Energy, LG&E and KU since August 2001.

Victor A. Staffieri (Age 46). Chairman, President and Chief Executive Officer of LG&E Energy, LG&E and KU, April 2001 to present. He served as President and Chief Operating Officer of LG&E Energy, LG&E and KU from February 1999 to April 2001; Chief Financial Officer of Energy and LG&E, May 1997 to February 2000; Chief Financial Officer of KU, May 1998 to February 2000; President, Distribution Services Division of LG&E Energy, December 1995 to May 1997; Senior Vice President, General Counsel and Public Policy of LG&E Energy and LG&E from November 1992 to December 1993. Mr. Staffieri has been a director of Powergen, LG&E Energy, LG&E and KU since April 2001.

Nominees for Directors with Terms Expiring at the directors whose terms2003 Annual Meeting of office continue afterShareholders

Edmund A. Wallis (Age 62). Mr. Wallis is Chairman of Powergen plc. He was appointed a director of Powergen plc on October 22, 1998, serving as Chairman of such Board since that date. He was also Chief Executive of Powergen from October 1998 until February 21, 2001. He had been Chief Executive of Powergen UK plc since March 1990 and Chairman since July 1996. He is a non-executive director of Mercury European Privatisation Trust plc and a non-executive director of London Transport. He was also formerly non-executive chairman of LucasVarsity plc. Mr. Wallis has been on the 1999Board of Directors of LG&E and KU since December 2000.

Dr. David K-P Li (Age 62). Dr. Li was appointed a director of Powergen plc on October 22, 1998, having been a non-executive director of Powergen UK plc since January 1998. He is chairman and chief executive of The Bank of East Asia Limited, having been a director since 1977, and holds directorships of numerous companies in the Far East and elsewhere, including The Hong Kong and China Gas Company Limited. Dr. Li has been a director of LG&E and KU since December 2000.

Nominees for Directors with Terms Expiring at the 2004 Annual Meeting.

NOMINEES FOR DIRECTORS WITH TERMS EXPIRING AT 2002 ANNUAL MEETING OF

SHAREHOLDERS

Meeting of Shareholders

MIRA S. BALL (AGE 64)

Mrs. Ball has been Secretary-Treasurer and Chief Financial Officer of

[PHOTO] Ball Homes, Inc., a residential developer and property management

company in Lexington, Kentucky, since August 1959. Mrs. Ball is a

graduate of the University of Kentucky. Mrs. Ball has been a director

of LG&E Energy and LG&E since May 1998 and of KU since 1992.

ROGER W. HALE (AGE 55)

Mr. Hale has been a Director and Chairman of the Board and Chief

Executive Officer of LG&E Energy since August 1990. Mr. Hale served as

[PHOTO1] President of LG&E Energy from August 1990 to May 1998. Mr. Hale has

also been Chief Executive Officer and a Director of LG&E since June

1989, Chairman of the Board of LG&E since February 1, 1990, and served

as President of LG&E from June 1989 until January 1, 1992. Mr. Hale has

been a Director and Chairman of the Board and Chief Executive Officer

of KU since May 1998. Prior to his coming to LG&E, Mr. Hale served as

Executive Vice President of Bell South Enterprises, Inc. Mr. Hale is a

graduate of the University of Maryland, and received a master's degree

in management from the Massachusetts Institute of Technology, Sloan

School of Management. Mr. Hale is also a member of the Board of

Directors of Global TeleSystems Group, Inc. and H&R Block, Inc.

DAVID B. LEWIS (AGE 54)

Mr. Lewis is a founding partner of the law firm of Lewis & Munday, a

[PHOTO] Professional Corporation, in Detroit, Michigan. Since 1972, Mr. Lewis

has served as Chairman of the Board and a Director of the firm. Mr.

Lewis is a graduate of Oakland University and received his law degree

from the University of Michigan Law School. He also received a master's

degree in business administration from the University of Chicago

Graduate School of Business. Mr. Lewis has been a director of LG&E

Energy and LG&E since November 1992 and of KU since May 1998. Mr. Lewis

is also a member of the Board of Directors of TRW, Inc., M.A. Hanna

Company and Comerica Bank, a subsidiary of Comerica Incorporated.

Sir Frederick Crawford (Age 70). Sir Frederick was appointed a director of Powergen plc on October 22, 1998, having been a non-executive director of Powergen UK plc since June 1990. He is chairman of the Criminal Cases Review Commission and a Fellow of the Royal Academy of Engineering. He has held appointments as Professor of Electrical Engineering at Stanford University, and as Vice-Chancellor of

4

ANNE H. MCNAMARA (AGE 51)

Mrs. McNamara has been Senior Vice President and General Counsel of AMR

[PHOTO] Corporation and its subsidiary, American Airlines, Inc., since June

1988. Mrs. McNamara is a graduate of Vassar College, and received her

law degree from Cornell University. She has been a director of LG&E

Energy and LG&E since November 1991 and of KU since May 1998. Mrs.

McNamara is also a member of the Board of Directors of The SABRE Group

Holdings, Inc.

FRANK V. RAMSEY, JR. (AGE 67)

Mr. Ramsey has been President and a Director of Dixon Bank, Dixon,

[PHOTO] Kentucky, since October 1972. Mr. Ramsey is a graduate of the

University of Kentucky. Mr. Ramsey has been a director of LG&E Energy

and LG&E since May 1998 and of KU since 1986.

NOMINEES FOR DIRECTORS WITH TERMS EXPIRING AT 2001 ANNUAL MEETING OF

SHAREHOLDERS

CAROL M. GATTON (AGE 66)

Mr. Gatton has been Chairman and Director of Area Bancshares Corpora-

[PHOTO] tion, an Owensboro, Kentucky bank holding company, since April 1976.

Mr. Gatton is also owner of Bill Gatton Chevrolet-Cadillac-Isuzu in

Bristol, Tennessee. Mr. Gatton is a graduate of the University of

Kentucky, and received a master's degree in business administration

from the University of Pennsylvania, Wharton School of Business. Mr.

Gatton has been a director of LG&E Energy and LG&E since May 1998 and

of KU since 1996.

LEE T. TODD, JR., PH.D. (AGE 52)

Dr. Todd has been President and Chief Executive Officer and Director of

[PHOTO] DataBeam Corporation, a Lexington, Kentucky high-technology firm, since

April 1976. Dr. Todd is a graduate of the University of Kentucky. He

also received a master's degree and doctorate in electrical engineering

from the Massachusetts Institute of Technology. Dr. Todd has been a

director of LG&E Energy and LG&E since May 1998 and of KU since 1995.

5

NOMINEES FOR DIRECTORS WITH TERMS EXPIRING AT 2000 ANNUAL MEETING OF

SHAREHOLDERS

WILLIAM L. ROUSE, JR. (AGE 66)

Mr. Rouse was Chairman of the Board and Chief Executive Officer and

[PHOTO] director of First Security Corporation of Kentucky, an Owensboro,

Kentucky multi-bank holding company, prior to his retirement in 1992.

Mr. Rouse is a graduate of the University of Kentucky. Mr. Rouse has

been a director of LG&E Energy and LG&E since May 1998 and of KU since

1989. Mr. Rouse is also a member of the Board of Directors of Ashland,

Incorporated and Kentucky-American Water Company, a subsidiary of

American Water Works Company, Inc.

CHARLES L. SHEARER, PH.D. (AGE 56)

Dr. Shearer has been President of Transylvania University since July

[PHOTO] 1983. Dr. Shearer is a graduate of the University of Kentucky and

received a master's degree in diplomacy and international commerce from

that institution. He also received a master's degree and a doctorate in

economics from Michigan State University. Dr. Shearer has been a

director of LG&E Energy and LG&E since May 1998 and of KU since 1987.

DIRECTORS WHOSE TERMS EXPIRE AT 2001 ANNUAL MEETING OF SHAREHOLDERS

OWSLEY BROWN II (AGE 56)

Mr. Brown has been the Chairman and Chief Executive Officer of Brown-

[PHOTO] Forman Corporation, a consumer products company, since July 1995, and

was President of Brown-Forman Corporation from 1987 to 1995. Mr. Brown

was first named Chief Executive Officer of Brown-Forman Corporation in

July 1994. Mr. Brown is a graduate of Yale University, and received his

master's degree in business administration from Stanford University. He

has been a director of LG&E Energy since August 1990, of LG&E since May

1989 and KU since May 1998. Mr. Brown is also a member of the Board of

Directors of Brown-Forman Corporation and North American Coal

Corporation, a subsidiary of NACCO Industries, Inc.

GENE P. GARDNER (AGE 69)

Mr. Gardner has been Chairman of Beaver Dam Coal Company, which is

[PHOTO] engaged in the ownership and development of coal properties, since

April 1983. Mr. Gardner is a graduate of the University of Louisville

and of the Advanced Management Program of the University of Virginia,

Colgate-Darden Graduate School of Business. Mr. Gardner has been a

director of LG&E since July 1979 and served as a director of LG&E

Energy from August 1990 until May 1998. He is also a member of the

Board of Directors of Commonwealth Bank and Trust Company, Commonwealth

Financial Corporation and Thomas Industries, Inc.

6

J. DAVID GRISSOM (AGE 60)

Mr. Grissom has been Chairman of Mayfair Capital, Inc., a private

[PHOTO] investment firm, since April 1989. He served as Chairman and Chief

Executive Officer of Citizens Fidelity Corporation from April 1977

until March 31, 1989. Upon the acquisition of Citizens Fidelity

Corporation by PNC Financial Corp. in February 1987, Mr. Grissom served

as Vice Chairman and as a Director of PNC Financial Corp. until March

1989. Mr. Grissom is a graduate of Centre College and the University of

Louisville School of Law. Mr. Grissom has been a director of LG&E

Energy since August 1990, of LG&E since January 1982 and of KU since

May 1998. He is also a member of the Board of Directors of Providian

Financial Corporation and Churchill Downs, Inc.

DIRECTORS WHOSE TERMS EXPIRE AT 2000 ANNUAL MEETING OF SHAREHOLDERS

WILLIAM C. BALLARD, JR. (AGE 58)

Mr. Ballard has been of counsel to the law firm of Greenebaum Doll &

[PHOTO] McDonald PLLC since May 1992. He served as Executive Vice President and

Chief Financial Officer from 1978 until May 1992, of Humana, Inc., a

healthcare services company. Mr. Ballard is a graduate of the

University of Notre Dame, and received his law degree, with honors,

from the University of Louisville School of Law. He also received a

Master of Law degree in taxation from Georgetown University. Mr.

Ballard has been a director of LG&E Energy since August 1990, of LG&E

since May 1989 and of KU since May 1998. Mr. Ballard is also a member

of the Board of Directors of United Healthcare Corp., Health Care REIT,

Inc., Healthcare Recoveries, Inc., MidAmerica Bancorp, American Safety

Razor, Inc. and Jordan Telecommunications Products, Inc.

JEFFERY T. GRADE (AGE 55)

Mr. Grade has been Chairman and Chief Executive Officer and Director of

[PHOTO] Harnischfeger Industries, Inc., which is engaged in the manufacture and

distribution of equipment for the mining and papermaking industries,

since January 1993. He served as President and Chief Executive Officer

from 1992 to 1993 and President and Chief Operating Officer from 1986

to 1992. Mr. Grade is a graduate of the Illinois Institute of

Technology and received a master's degree in business administration

from DePaul University. Mr. Grade has been a director of LG&E Energy

and LG&E since October 1997 and of KU since May 1998. He is also a

member of the Board of Directors of Case Corporation.

T. BALLARD MORTON, JR. (AGE 66)

Mr. Morton has been Executive in Residence at the College of Business

[PHOTO] and Public Administration of the University of Louisville since 1983.

Mr. Morton is a graduate of Yale University. Mr. Morton has been a

director of LG&E Energy since August 1990, of LG&E since May 1967 and

of KU since May 1998. Mr. Morton is also a member of the Board of

Directors of the Kroger Company.

7

Aston University for 16 years. He was formerly a non-executive director of Legal and General Group plc and Rexam plc. Sir Frederick has been a director of LG&E and of KU since December 2000.

David J. Jackson (Age 48). Mr. Jackson is General Counsel and Company Secretary of Powergen plc. He has served on the Board of Directors of LG&E Energy, LG&E and KU since December 2000.

INFORMATION CONCERNING THE BOARD OF DIRECTORS

Each member of the Board of Directors of LG&E is also a directormember of the Board of Directors of KU. Certain members are also directors of Powergen or LG&E Energy, and KU, with the exception of Mr. Gardner and Dr. Swain, who serve only

on the LG&E Board.as described above. The committees of the Board of Directors of LG&E include an Audit Committee a Compensation Committee, a Nominating and Governance Committee

and a Long-Range PlanningCompensation Committee. The directors who are members of the various committees of LG&E serve in the same capacity for purposes of the LG&E

Energy and KU Board of Directors, with the exception of Mr. Gardner and Dr.

Swain, who currently serve on no committees. As discussed earlier, Dr. Swain is

not standing for re-election and has indicated his present intention to retire

following the Annual Meeting.Directors.

During 1998,2000, there were a total of seven meetings of the LG&E Board. All directors attended 75% or more of the total number of meetings of the Board of Directors and Committeescommittees of the Board on which they served withserved. Information concerning the exceptionBoards of Jeffery T. Grade.

COMPENSATION OF DIRECTORSDirectors of LG&E and KU shown below generally relates to the period prior to the completion of the Powergen-LG&E Energy merger.

Compensation of Directors

Directors who are also officers of Powergen, LG&E Energy or its subsidiaries receive no compensation in their capacities as directors. During 1998,2000, non-employee directors received a retainer of approximately $2,333 per month, or $28,000 annually ($30,00030,300 annually for committee chairmen), a fee for Board meetings of $1,100$1,300 per meeting, a fee for each committee meeting of $1,000$1,150 and, where appropriate, reimbursement for expenses incurred in traveling to meetings. Non-employee directors residing out of Kentucky received an additional $1,000 compensation for each Board or committee meeting they attended. The foregoing amounts represent the aggregate fees paid to directors in their capacities as directors of LG&E Energy, LG&E and KU as applicable, during 1998. Upon their resignation as2000.

Prior to the Powergen-LG&E Energy merger, non-employee directors of LG&E Energy during 1998, Messrs. Dabney and Gardner and Dr. Swain each received

one-time awards of $10,000 in recognition of their years of service on that

Board.

Non-employee directors of LG&E mayKU could elect to defer all or a part of their fees (including retainers, fees for attendance at regular and specialannual meetings, committee meetings and travel compensation) pursuant to the former LG&E Energy Corp. Deferred Stock Compensation Plan (the "Deferred Stock Plan").Plan. Each deferred amount iswas credited by LG&E Energy to a bookkeeping account and then iswas converted into a stock equivalent on the date the amount is credited. The numberFollowing completion of stockthe Powergen-LG&E Energy merger, all share equivalents creditedwere converted into the right to receive the merger consideration of $24.85 in cash per share and were paid out in accordance with the terms of the plan and the plan was terminated.

Prior to the director is based upon the average of the high and

the low sale price of LGPowergen-LG&E Energy Common Stock on the New York Stock Exchange

for the five trading days prior to the conversion. Additional stock equivalents

will be added to stock accounts at the time that dividends are declared on LG&E

Energy Common Stock, in an amount equal to the amount of LG&E Energy Common

Stock that could be purchased with dividends that would be paid on the stock

equivalents if converted to LG&E Energy Common Stock. In the event that LG&E

Energy is a party to any consolidation, recapitalization, merger, share exchange

or other business combination in which all or a part of the outstanding LG&E

Energy Common Stock is changed into or exchanged for stock or other securities

of the other entity or LG&E Energy, or for cash or other property, the stock

account of a participating director shall be converted to such new securities or

consideration equal to the amount each share of LG&E Energy Common Stocknon-employee directors also received multiplied by the number of share equivalents in the stock account.

A director will be eligible to receive a distribution from his or her

account only upon termination of service by death, retirement or otherwise.

Following departure from the Board, the distribution will occur, at the

director's election, either in one lump sum or in no more than five annual

installments. The distribution will be made, at the director's election, either

in LG&E Energy Common Stock or in cash equal to the then-market price of the

LG&E Energy Common Stock allocated to the director's stock account. At February

16, 1999, eight directors of LG&E were participating in the Deferred Stock Plan.

Non-employee directors who are also directors of LG&E Energy also receive stock options pursuant to the former LG&E Energy Corp. Stock Option Plan for Non-Employee Directors (the "Directors'

8

Option Plan"), which was approvedDirectors. In connection with the Powergen-LG&E Energy merger, options held by LG&E Energy's shareholdersa director under this plan were converted at the 1994

Annual Meeting. Underdirector's election into either options to acquire American Depositary Shares of Powergen (at an agreed upon exchange ratio) or cash and the termsplan was terminated.

As noted earlier, since the completion of the Directors' Option Plan, upon initial

election or appointment toPowergen-LG&E Energy merger, certain current members of the LG&E Energy Board, each new director, who has not

been an employee or officer of LG&E Energy within the preceding three years,

receives an option grant for 4,000 shares of LG&E Energy Common Stock. Following

the initial grant, eligible directors receive an annual option grant of 4,000

sharesand KU boards serve on the first WednesdayBoard of each February. Option grantsDirectors of Powergen plc. In that capacity, these members received or will receive certain compensation during 2000 and 2001. Information regarding such compensation is incorporated by reference from Powergen's Annual Report on Form 20-F for 1994-1996 were

for 2,000 shares, all of which were adjusted in April 1996 to reflect a

two-for-one stock split. The option exercise price per share for each share of

LG&E Energy Common Stock is the fair market value at the time of grant. Options

granted are not exercisable during the first twelve months from the date of

grant and will terminate 10 years from the date of grant. In the event of a

tender offer or an exchange offer for shares of LG&E Energy Common Stock, all

then exercisable, but unexercised options granted under the Directors' Option

Plan will continue to be exercisable for thirty days following the first

purchase of shares pursuant to such tender or exchange offer.

The Directors' Option Plan authorizes the issuance of up to 500,000 shares

of LG&E Energy Common Stock, of which 251,000 shares are subject to existing

options at a weighted average per share price of $22.83. As of February 16,

1999, each non-employee director held 20,000 exercisable options and 4,000

unexercisable options to purchase LG&E Energy Common Stock,year ended December 31, 2000 as filed with the exception

of Dr. SwainSecurities and Mr. Grade, who held 16,000 and 8,000 exercisable options,

respectively, and 4,000 unexercisable options each, and Messrs. Gatton, Ramsey

and Rouse, Mrs. Ball and Drs. Shearer and Todd, who each held 4,000 exercisable

and 4,000 unexercisable options. The number of shares subject to the Directors'

Option Plan and subject to awards outstanding under the plan will adjust with

any stock dividend or split, recapitalization, reclassification, merger,

consolidation, combination or exchange of shares, or any similar corporate

change.

AUDIT COMMITTEEExchange Commission.

Audit Committee

The Audit Committee of the Board is composed of Messrs. Ballard, Brown,

Gatton, Grade, Grissom, LewisMr. Sydney Gillibrand and Ramsey, Mrs. Ball and Drs. Shearer and Todd.Sir Frederick Crawford, with one vacancy. During 1998,2000, the Audit Committee maintained direct contact with the

5

independent auditors and LG&E's and KU's Internal Auditor to review the following matters pertaining to LG&E and to LG&E Energy and its subsidiaries, including KU: the adequacy of accounting and financial reporting procedures; the adequacy and effectiveness of internal accounting controls; the scope and results of the annual audit and any other matters relative to the audit of these companies' accounts and financial affairs that the Committee, the Internal Auditor, or the independent auditors deemed necessary. The Audit Committee met threetwo times during 1998.

COMPENSATION COMMITTEE2000.

Remuneration Committee

The CompensationRemuneration Committee, composed of non-employee directors, approveshas succeeded to certain of the functions performed by the former Compensation Committee in connection with the compensation of the Chief Executive Officer and the executive officers of LG&E

Energy, LG&E and KU. The Committee makes recommendations to the full Board regarding benefits provided to executive officers and the establishment of various employee benefit plans. The membersDr. David K-P Li is the current member of the Compensation Committee are

Messrs. Gatton, Grade, Grissom, Morton, Ramsey and Rouse and Mrs. McNamara.Remuneration Committee. The former Compensation Committee met fivethree times during 1998.

NOMINATING AND GOVERNANCE COMMITTEE

The Nominating and Governance Committee is composed of the Chairman of the

Board and certain other directors. The Committee reviews and recommends to the

Board of Directors nominees to serve on the Board and their compensation. The

Committee considers nominees suggested by other members of the Board, by members

of management and by shareholders. To be considered for inclusion in the slate

of nominees proposed by the Board of Directors at an annual meeting, shareholder

recommendations must be submitted in writing to the Secretary of LG&E not later

than 120 days prior to the Annual Meeting. In addition, the Articles of

Incorporation and bylaws of LG&E contain procedures governing shareholder

nominations for election of directors at a shareholders'

9

meeting. The Chairman of the Annual Meeting may refuse to acknowledge the

nomination of any person not made in compliance with these procedures. The

members of the Nominating and Governance Committee are Messrs. Ballard, Brown,

Hale (ex officio), Lewis, Ramsey and Rouse, Mrs. Ball and Mrs. McNamara and Dr.

Shearer. The Nominating and Governance Committee met two times during 1998.

LONG-RANGE PLANNING COMMITTEE

The Long-Range Planning Committee is composed of Messrs. Grade, Grissom,

Lewis, Morton, Rouse and Todd, Mrs. Ball and Mrs. McNamara and Dr. Shearer. The

Long-Range Planning Committee considers and makes recommendations to the Board

regarding LG&E's future strategy and direction, long-term goals and other

matters of long-term importance. The Long-Range Planning Committee did not meet

during 1998.

2000.

6

PROPOSAL NO. 2

APPROVAL OF INDEPENDENT AUDITORS FOR 19992001

Based upon the recommendation of the Audit Committee, the Board of Directors, subject to ratification by shareholders, has selected Arthur AndersenPricewaterhouseCoopers LLP as independent auditors to audit the accounts of LG&E Energy and LG&E for the fiscal year ending December 31, 1999. Arthur Andersen2001. PricewaterhouseCoopers has audited the accounts of LG&EPowergen for many years (as welland effective April 30, 2001, following the completion of the Powergen-LG&E Energy merger in December 2000, the firm was selected as thoseindependent auditors for the Company. The Board of KU),Directors and Audit Committee of LG&E Energy

since its organization in 1990. The shareholders previously approved the employmentselection of the firm at the Annual MeetingPricewaterhouseCoopers on May 30, 2001.

Prior to April 22, 1998.

Representatives30, 2001, Arthur Andersen LLP had served as LG&E's independent auditors. The reports of Arthur Andersen LLP willon LG&E's financial statements for the two years ended December 31, 2000 and 1999 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles. In connection with the audits of LG&E's financial statements for each of the years ended December 31, 2000 and 1999, and through April 30, 2001, there were no disagreements with Arthur Andersen LLP on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedures which, if not resolved to the satisfaction of Arthur Andersen LLP, would have caused the firm to make reference to the matter in their reports.

Representatives of PricewaterhouseCoopers LLP and Arthur Andersen LLP may be present at the Annual

Meeting. Such representativesannual meeting and available to respond to questions and will be given the opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.desire.

As previously stated, LG&E Energy intends to vote all of the outstanding shares of common stock of the Company in favor of approval of the appointment of Arthur AndersenPricewaterhouseCoopers LLP as independent auditors, and since LG&E Energy's ownership of such common stock represents over 96% of the voting power of the Company, the approval of such independent auditors is assured.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE APPROVAL OF THE APPOINTMENT OF THE INDEPENDENT AUDITORS.

10

7

REPORT OF THE COMPENSATIONREMUNERATION COMMITTEE

ON EXECUTIVE COMPENSATION

The

Following the December 11, 2000 completion of the merger transaction involving LG&E Energy and Powergen, a Remuneration Committee of the Boards of Directors of LG&E and KU (collectively, the "Companies") was established to succeed to certain of the relevant duties formerly performed by the Compensation Committee of the Board of Directors isof the Companies. This report describes actions taken by the former Compensation Committee as constituted during 2000. The current Remuneration Committee does not include any individuals who were previously on the Compensation Committee.

The former Compensation Committee was comprised wholly of non-employee directors of LG&E Energy, LG&E and makesKU and made all decisions regarding the compensation of LG&E Energy's, LG&E's and KU's executive officers, including the setting of base pay and the administration of LG&E Energy's Omnibus Long-Term Incentive Plan (the "Long-Term Plan") and Short-Term Incentive Plan (the "Short-Term Plan"), each as defined herein. The Company'scurrent Remuneration Committee is comprised entirely of non-employee directors of LG&E, KU and Powergen.

The Companies' executive compensation program and the target awards and opportunities for executives are designed to be competitive with the compensation and pay programs of comparable companies, including utilities, utility holding companies and companies in general industry nationwide. The executive compensation program has been developed and implemented over time through consultation with, and upon the recommendations of, nationally-recognizedrecognized executive compensation consultants. The CompensationRemuneration Committee and the Board of Directors have continued access to such consultants as desired, and are provided with independent compensation data for their review.

LG&E is a principal subsidiary of LG&E Energy. As noted above, the members

of the Compensation Committee and Board of Directors of LG&E also serve in the

same capacity for LG&E Energy. Certain executive officers of LG&E are also

executive officers of LG&E Energy. For those individuals references below to the

Compensation Committee and Board of Directors refer to the Compensation

Committee and Board of Directors of both LG&E and LG&E Energy unless otherwise

indicated, and discussions of their compensation include compensation earned for

services to both LG&E and LG&E Energy.

Set forth below is a report submitted by

the members of the Compensation Committee addressing LG&E Energy's&E's compensation policies during 19982000 for its officers, of LG&E and LG&E Energy, including the executive officers named in the following tables. TheIn many cases, the executive officers also serve in similar capacities for affiliates of LG&E, including LG&E Energy and KU. For each of the executive officers of LG&E participate inand KU, the Long-Term Planpolicies and Short-Term Plan of LG&E Energy. References

to stock, shareholder performance or shareholder return relateamounts discussed below are for all services to LG&E, Energy

Common Stock.

COMPENSATION PHILOSOPHY

There are three major components ofKU and their affiliates.

Compensation Philosophy

During 2000, LG&E's executive compensation program:program had three major components: (1) base salary; (2) short-term or annual incentives; and (3) long-term incentives. LG&EThe Companies developed itstheir executive compensation program to focus on both short-term and long-term business objectives that are designed to enhance overall shareholder value. The short-term and long-term incentives arewere premised on the belief that the interests of executives should be closely aligned with those of LG&E Energy's shareholders.shareholders. Based on this philosophy, these two portions of each executive's total compensation package arewere placed at risk and arewere linked to the accomplishment of specific results that arewere designed to benefit LG&E Energy's shareholders in both the short-term and long-term. Under this pay-for-performance approach, a highly competitive level of compensation cancould be earned in years of strong performance. Conversely, in years of below-average performance, compensation maymight decline below competitive benchmarks.

The executive compensation program also recognizesrecognized that LG&E and LG&E

Energy'sthe Companies' compensation practices must be competitive not only with utilities and utility holding companies, but also with companies in general industry to ensure that a stable and successful management team can be recruited and retained. The Compensation Committee believesbelieved that the Company'sCompanies' most direct competitors for executive talent are not limited to the companies that would be included in the utility industry index against which shareholder returns may be compared. For this reason, the various compensation peer groups as establisheddiscussed below, arewere not the same as the utility industry index in the Comparison of Five-Year Total Return graph included on page 16 ofin this proxy statement.

8

Pursuant to this competitive market positioning philosophy, in establishing compensation levels for all executive positions for 1998,2000, the former Compensation Committee reviewed competitive compensation information for general industry companies with revenue between $2 - $3$2—$4 billion (the "Survey

11

19982000 to approach the 50th percentile of the competitive range from the Survey Group. Salaries, short-term incentives and long-term incentives for 19982000 are described below.

The 19982000 compensation information set forth in other sections of this proxy statement, particularly with respect to the tabular information presented, reflects the considerations set forth in this report. The Base Salary, Short-Term Incentives, and Long-Term Incentives sections that follow address the compensation philosophy for 19982000 for all executive officers except for Mr. Roger W. Hale. Mr. Hale's compensation iswas determined in accordance with the terms of his employment agreement (See "Chief Executive Officer Compensation" on page 14

of this proxy statement for a description of his 19982000 compensation). Pursuant to

the terms of existing employment and change in control agreements, severance

amounts were paid to certain departing executives during 1998. See "Employment

Contracts and Termination of Employment Arrangements and Change in Control

Provisions" on page 21 of this proxy statement.

BASE SALARY

Base Salary

The base salaries for LG&E executive officers for 19982000 were designed to be competitive with the Survey Group at approximately the 50th percentile of the base salary range for executives in similar positions with companies in the Survey Group. Actual base salaries were determined based on individual performance and experience.

SHORT-TERM INCENTIVES

In

Short-Term Incentives

The Short-Term Plan provided for Company Performance Awards and Individual Performance Awards, each of which was expressed as a percentage of base salary and each of which was determined independent of the first quarter of 1998, theother. The former Compensation Committee established the performance goals for the Company Performance Awards and Individual Performance Awards.Awards at the beginning of the 2000 performance year. Payment of Company Performance Awards for executive officers was based 100% on Net Income Available for Common Stock ("NIAC"), while paymentincluding certain adjustments deemed appropriate by the Committee. Payment of Individual Performance Awards was based 100% on Management Effectiveness, which includes a customer satisfaction element for certain participants. AtThe awards varied within the beginning of the

third quarter, the Compensation Committee established revised performance goals

to reflect the fundamental business shifts effected by LG&E Energy during 1998,

particularly the decision to discontinue merchant energy marketing and trading

operations and the completion of the KU Merger and the Big Rivers leasing

transactions. For participants with performance goalsexecutive officer group based upon LG&E Energy

Corp. and LG&E Energy Marketing performance measures, the Compensation Committee

determined that no Company Performance Awards would be payable with respect to

first and second quarter operations and results. Revised Company Performance

Award targets for July through December 1998 were established based upon LG&E

Energy's revised plannature of continuing business operations foreach individual's functional responsibilities.

For 2000, the third and fourth

quarters of the year.

For 1998, the revised Company Performance Award targets for executive officers ranged from 21% to 30%36% of base salary, and the Individual Performance Award targets ranged from 14% to 20%24% of base salary. Both awards were established to be competitive with the 50th percentile of such awards granted to comparable executives employed by companies in the Survey Group. The individual officers were eligible to receive from 0% to 175% of their targeted amounts, dependent upon Company and individual performance during 19982000 as measured by NIAC with regard to Company Performance Awards, and were eligible to receive from 0% to 175% of their targeted amounts dependent upon individual performance as measured by Management Effectiveness with regard to Individual Performance Awards. As indicated above, no

Using LG&E Energy and subsidiaries performance to date, in December 2000, in connection with the pending completion of the LG&E Energy-Powergen merger, the former Compensation Committee determined and established projected annual performance against targets for Company Performance Awards were paid

in respect of firstAwards. Effective with the merger, the Short-Term Plan was then terminated and, second quarter operations or results for participants

withusing the projected performance, goals based upon LG&E Energy Corp. and LG&E Energy Marketing

performance measures. Based upon performances against the revised targets for

the second-half of 1998, payouts of Company Performance Awards for 19982000 to the executive officers rangedwere paid ranging from 9%24.7% to 33%45%, of base salary. Payouts for the Individual Performance Awards to the executive officers ranged from 20%25% to 35%42%, of base salary.

12

LONG-TERM INCENTIVES

The

Long-Term Incentives

Pursuant to its terms, the Long-Term Plan iswas administered by a committee of not less than three non-employee directors of LG&E Energy who arewere appointed by the LG&E Energy Board of Directors. At this time,Directors. During 2000, the

9

Compensation Committee administers the Long-Term

Plan.performed this function. The Long-Term Plan providesprovided for the grant of any or all of the following types of awards: stock options, stock appreciation rights, restricted stock, performance units and performance shares. In 1998,2000, the former Compensation Committee chose to award stock options and performance units to executive officers.

The Compensation Committee determined the competitive long-term grants to be awarded for each executive based on the long-term awards for the 50th percentile of the Survey Group. The aggregate expected value of the stock options and performance units (delivered 50%approximately 40% in the form of performance units and 50%60% in the form of nonqualified stock options in 1998)2000) was intended to approach the expected value of long-term incentives payable to executives in similar positions with companies in the 50th percentile of the Survey Group, depending upon achievement of targeted Company performance.

Stock options were granted to executive officers and senior management during the first quarter of 19982000 at an exercise price equal to the fair market value at the time of grant and were subject to a one-year vesting requirement. During the year, newly hired or promoted officers were also eligible to receive pro-rated stock option grants under the Long-Term Plan. Since options were granted with an exercise price equal to the market value of the Common StockLG&E Energy's common stock at the time of grant, they provideprovided no value unless LG&E Energy's stock price increasesincreased after the grants are awarded. Once the options vest,vested, they arewere exercisable over a nine-year term. These awards arewere thus tied to stock price appreciation in excess of the stock's value at time of grant, rewarding executives as if they shared in the ownership of LG&E Energy. The estimated number of shares subject to options was determined by taking the expected value to be provided in options, as determined above, and dividing that amount by the estimated current value of an option using a variation of the Black-Scholes Option Pricingoption pricing methodology provided by the outside compensation consultant. Prior awards were not considered when making new grants. The actual number of options granted were then determined by approximating the average by officer level within LG&E Energy. Pursuant to the Plan's provisions, all outstanding options vested in June 2000 upon shareholder approval of the LG&E Energy-Powergen merger. At the time of the merger, all outstanding options were converted, at the election of the holder, into options to acquire Powergen ADRs or cash based upon the difference between the option exercise price and the per share merger consideration amount.

The number of performance units granted was determined by taking the amount of the executive's long-term award to be delivered in performance units (adjusted on a present value basis), as determined above, and dividing that amount by the fair market value of LG&E Energy Common Stockcommon stock on the date of the grant. The future value of the performance units iswas substantially dependent upon the changing value of LG&E Energy's Common Stockcommon stock in the marketplace. Each executive officer iswas entitled to receive from 0% to 150% of the performance units contingently awarded to the executive based on LG&E Energy's total shareholder return over a three-year period (defined as share price increase plus dividends paid, divided by share price at beginning of the period) measured against the total shareholder return for such period ("TSR") by a peer group selected by the Committee. The peer group for measuring LG&E Energy's TSR performance (the "Long-Term Plan Peer Group") consistsconsisted of approximately 80 utility holding companies and gas and electric utilities.(1)

Payouts of long-term incentive awards in February 1999 were based on LG&E

Energy's performance during the 1996-1998 period. During such period, LG&E

Energy's performance was at the 63rd percentile of its comparison group with

respect to TSR, resulting in payouts of 125% of the contingent awards. The

performance units are payable 50% in LG&E Energy Common Stock and 50% in cash.

- ------------------------

(1) 1

- 1

- While similar, the utilities and holding companies that

arewere in the Long-Term Plan Peer Grouparewere not necessarily the same as those in the Standard & Poor's Utility Index used in the Company Performance Graphon page 16 of the proxy statementor the Survey Group. Nevertheless, in the judgment of the Compensation Committee, the companies in the Long-Term Plan Peer Groupcontinue to representrepresented the appropriate peer group for performance unit compensation purposes.13Long-term incentive

Pursuant to the change in control provisions of the Long-Term Plan, payouts of the three open performance period awards were also paid to certain former KU officers in

February 1999 in respect of KU's performance during the 1996-1998 period under the KU Performance ShareLong-Term Plan (the "KU Plan"). Payouts were made at 100%occurred in June 2000 upon shareholder approval of contingent grants, based upon the Compensation Committee's assessment of KU's

performance during 1998 and KU's contribution to strong LG&E Energy performance

followingEnergy-Powergen merger and the Merger.amounts are included in the column "LTIP Payments" in the Summary Compensation Table below. These payouts were made inbased on LG&E Energy Common Stock to

four executive officersEnergy's performance through that time for each of the Company who were participantspartially completed 1998-2000, 1999-2001 and 2000-2002 performance

10

periods, respectively. For such periods, LG&E Energy's performance was at the 57th, 46th, and 97th percentiles, respectively, of its comparison group with respect to TSR.

Other

In connection with the LG&E Energy-Powergen merger, Messrs. Staffieri, McCall and Newton entered into revised employment and severance agreements. These agreements are discussed under "Employment Contracts and Termination of Employment Arrangements and Change in Control Provisions". In consideration for the cancellation of their prior agreements, the officers received payments described in that section. These payments are included in the KU Plan

prior"All Other Compensation" column in the Summary Compensation Table. Mr. Duncan, who resigned effective January 31, 2001, did not receive a payment at the time of the merger, but received a payment of $2,017,683 in January 2001 pursuant to the Merger.

CHIEF EXECUTIVE OFFICER COMPENSATIONterms of his existing change in control and non-disclosure and confidentiality agreements.

Chief Executive Officer Compensation

The compensation of Mr. Roger W. Hale, the Chief Executive Officer of LG&E and LG&E Energy, Mr.

Roger W. Hale, isduring 2000, was governed by the terms of an employment agreement. Following commencement of his service with LG&E in April 1989, Mr. Hale's employment agreement has been periodically updated by the Board to recognize his fundamental role in establishing LG&E Energy as a national and international diversified energy services company. Mr. Hale's 19971998 employment agreement (the "1997"1998 Agreement") wasprovided for a five year term ending on May 4, 2003. As part of the LG&E Energy-Powergen merger, Powergen, LG&E Energy and Mr. Hale entered into a new employment agreement dated February 25, 2000 (the "2000 Agreement") which became effective duringon December 11, 2000 at the periodeffective time of the LG&E Energy-Powergen merger. In consideration for the cancellation of his 1998 priorAgreement and associated change in control provisions, Mr. Hale received a payment equal to the May 4,

1998 closing ofseverance benefits he would have been entitled to if he had terminated his employment following the Merger. A revised employment agreement (the "Revised

Agreement") became effective upon such date and throughoutmerger. This payment is included in the remainder of

1998."All Other Compensation" column in the Summary Compensation Table. (See "Employment Contracts and Termination of Employment Arrangements and Change in Control Provisions" on page 21 of this proxy statement..)

The 1997 Agreement and the Revised1998 Agreement established the minimum levels of Mr. Hale's 1998 and post-merger2000 compensation, although the former Compensation Committee retained discretion to increase such compensation. For 1998,2000, the Compensation Committee compared Mr. Hale's compensation to that of chief executive officers of companies contained in the Survey Group as well asincluding electric and gas utilities and utility holding companies with comparable revenues, market capitalization and asset size. In setting long-term awards, the CompanyCompanies also considered survey data from various compensation consulting firms. Mr. Hale also receives LG&E Energyreceived Companies' contributions to the savings plan, similar to those of other officers and employees. Details of Mr. Hale's 19982000 compensation are set forth below.

BASE SALARY.

Base Salary. Mr. Hale was paid a total base salary of $700,000$816,200 during 1998.2000. This amount was based upon the minimum salary amount provided in the 19971998 Agreement, plus an increaseprior increases awarded by the Compensation Committee. The Compensation Committee, in determining Mr. Hale's annual salary, including increases, focused on his individual performance (including his management effectiveness, as described below), the growth of LG&E Energy and the compensation provided to other LG&E Energy, LG&E and KU officers. The 19982000 increase, granted in February 2000, was 20.7%

SHORT-TERM INCENTIVES.6%.

Short-Term Incentives. Mr. Hale's target short-term incentive award was 65%70% of his 19982000 base salary. Like allAs with other executive officers receiving short-term incentive awards, Mr. Hale was eligible to receive more or less than the targeted amount, based on Company performance and individual performance. His 19982000 short-term incentive payouts were based 70%60% on Company Performance Goals

and 30% on Individual Performance Goals.

In 1998, noachievement of Company Performance Award was paid to Mr. Hale in respecttargets and 40% on achievement of first and second quarter operations or results. HisIndividual Performance Award targets.

For 2000, the Company Performance Award payout for performance against the revised targets for the third and fourth

quartersMr. Hale was 23%49.5% of his 19982000 base salary. Mr. Hale'ssalary and the Individual Performance Award payout was 34%45% of his 19982000 base salary. Thesalary. As with the other executive

11

officers, in connection with the LG&E Energy-Powergen merger, the Company Performance Award was calculated based upon projected annual Company performance as described under the heading "Short-Term Incentives." In determining the Individual Performance Award, the Compensation Committee considered Mr. Hale's effectiveness in several areas in determiningincluding the final

Individual Performance Award. These included the financial and operational performance of LG&E Energy, LG&E, KU and other LG&E Energy subsidiaries, Company growth, customer satisfaction ratings, Company growth and other measures, such as LG&E Energy'sthe successful negotiation and completion of the leasingLG&E Energy-Powergen transaction, with Big Rivers.as well as other measures.

Long-Term Incentive Grant. In May 1998, the

Compensation Committee awarded Mr. Hale a special completion bonus of $250,000

as reward for his leadership role and contribution upon the successful closing

of the KU Merger. (See statement "Short-Term Incentives" on page 12 of this

proxy statement for a discussion of the revised Company Performance Award

targets).

14

LONG-TERM INCENTIVE GRANT. In 1998,2000, Mr. Hale received 133,588190,000 options and 39,24455,307 performance units for the 1998-20002000-2002 performance period. These amounts were determined in accordance with the terms of his 19971998 Agreement and were expected to provide

expected value representing approximately 150%175% of his base salary. The terms of the options and performance units (including the manner in which performance units are earned) for Mr. Hale arewere the same as for other executive officers, as described under the heading "Long-Term Incentives."

LONG-TERM INCENTIVE PAYOUT. In

Long-Term Incentive Payout. As with other executive officers, in connection with the 1996-1998 period,LG&E Energy-Powergen merger, Mr. Hale's Company Performance Awards were calculated based upon LG&E Energy's performance during the partially completed 1998-2000, 1999-2001 and 2000-2002 periods, respectively, as described under the heading "Long-Term Incentives." For such periods, LG&E Energy's performance was at the 63rd percentile57th, 46th, and 97th, percentiles, respectively, of its comparison group in TSR. That

resulted in a payout equal to 125% of the approved target. In addition, the

market value per share of LG&E Energy Common Stock increased from $21.22 at

grant to $28.31 during the performance period. This further increased the value

of the payout of the performance units originally awarded to Mr. Hale in 1996.

TAX MATTERS

Section 162(m) of the Code was enacted in 1993 and generally prohibits the

Company from deducting executive compensation in excess of $1,000,000.

Qualifying "performance based compensation" is not subject to this deduction

limitation if certain requirements are satisfied. It is the Compensation

Committee's general intent to preserve the deductibility of executive

compensation to the extent reasonably practicable and to the extent consistent

with its other compensation objectives. In an effort to ensure that certain

compensation payable under the Long-Term Plan and Short-Term Plan remain

deductible, the Compensation Committee and the Board of Directors recommended,

and the shareholders approved, modification of the Long-Term Plan and adoption

of a new Short-Term Plan in 1996, although not all of the compensation paid to

executive officers under these two plans constitutes performance based

compensation. A portion of compensation received by Mr. Hale in 1998 was not

deductible.

CONCLUSION

The Compensation Committee believes that the Company's executive

compensation system served the interests of the Company and its shareholders

effectively during 1998. The Compensation Committee takes very seriously its

responsibilities with respect to the Company's executive compensation system,

and it will continue to monitor and revise the compensation policies as

necessary to ensure that the Company's compensation system continues to meet the

needsTSR.

Member of the Company and its shareholders.

MEMBERS OF THE COMPENSATION COMMITTEE

J.Remuneration Committee

Dr. David Grissom, Chairman

Carol M. Gatton

Jeffery T. Grade

Anne H. McNamara

T. Ballard Morton, Jr.

Frank V. Ramsey, Jr.

William L. Rouse, Jr.

15

12

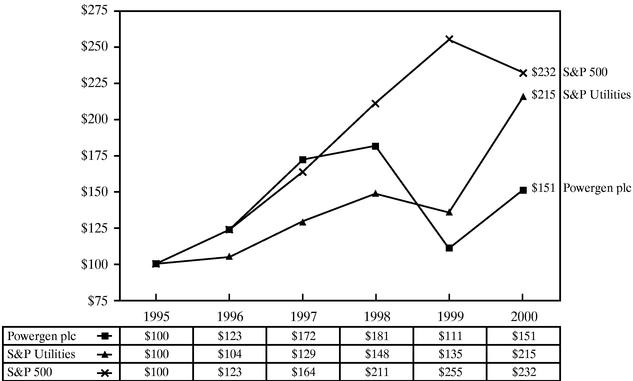

COMPANY PERFORMANCE

All of the outstanding Common Stock of LG&E is owned by LG&E Energy and, accordingly, there are no trading prices for LG&E's Common Stock. All of the common stock of LG&E Energy is indirectly owned by Powergen plc. The following graph reflects a comparison of the cumulative total return (change in stock price plus reinvested dividends) to shareholdersholders of LG&E Energy Common StockAmerican Depositary Shares ("ADS's") of Powergen plc from December 31, 1993,1995, through December 31, 1998,2000, with the Standard & Poor's 500 Composite Index and the Standard & Poor's Utility Index. The comparisons in this table are required by the Securities and Exchange Commission and, therefore, are not intended to forecast or be indicative of possible future performance of LG&E Energy Common Stock.

EDGAR REPRESENTATIONADS's of Powergen.

COMPARISON OF DATA POINTS USED IN PRINTED GRAPHIC

INDEXED RETURNS

YEARS ENDING

TOTAL SHAREHOLDER RETURNS

LG&E Energy Corp S&P Utilities S&P 500 Index

Dec-93 100.00 100.00 100.00

Dec-94 96.37 92.06 101.32

Dec-95 116.63 130.74 139.40

Dec-96 142.11 134.83 171.40

Dec-97 151.31 168.07 228.59

Dec-98 180.46 192.89 293.91

12/31/1993 1994 1995 1996 1997 1998

LG&E ENERGY $100 $96 $117 $142 $151 $180

S&P UTILITIES $100 $92 $131 $135 $168 $193

S&P 500 $100 $101 $139 $171 $229 $294

- ------------------------FIVE YEAR CUMULATIVE

TOTAL SHAREHOLDER RETURN (1)

- (1)

- Total Shareholder Return assumes $100 invested on December 31,

1993,1995, withquarterlyreinvestment of dividends.16

13

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following table shows the cash compensation paid or to be paid by LG&E or LG&E Energy, and any of its subsidiaries including KU, as well as certain other compensation paid or accrued for those years, to the Chief Executive Officer and the next four highest compensated executive officers of LG&E who were serving as such at December 31, 1998,2000, as required, in all capacities in which they served LG&E Energy or its subsidiaries during 1996, 19971998, 1999 and 1998:

SUMMARY COMPENSATION TABLE

2000 Summary Compensation Table